ATO phone taps?

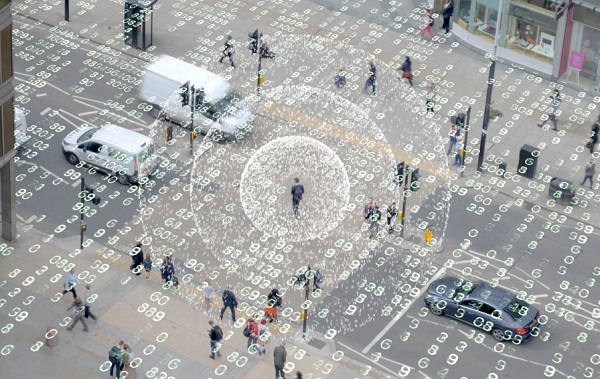

The ATO has been variously described in the media as one of the most powerful institutions in the country, with vast powers such as being able to forcibly enter a property and search for documents without a warrant, compelling the production of information and evidence, and issuing garnishee notices. Even with this vast power, the government is seeking to grant the ATO more powers including access to telecommunications data without a warrant. This may include messages, phone calls, emails, web-browsing history, files etc, under an expanded definition of “communication”.

DHA Consultation Paper

The ATO may soon be getting more access powers if proposals suggested in a Department of Home Affairs consultation paper on electronic surveillance are implemented. Among other things, the paper proposes to grant additional powers to agencies such as the ATO and the Australian Transaction Reports and Analysis Centre (AUSTRAC) where “a clear and compelling case is made by that agency”.

Currently, the Telecommunications (Interception and Access) Act, Telecommunications Act, and the Criminal Code Act, contain offences and prohibitions that prevent people, including government agencies, from accessing a person’s communications and information on a person’s computer or other device. Some exceptions exist where a particular agency is granted electronic surveillance powers (e.g. ASIO, various State Police, and Anti-corruption bodies).

Expanded intercept powers

In relation to AUSTRAC, the proposed power to access telecommunications data will be exercised for the purpose of fulfilling its dual financial intelligence and regulatory roles to prevent money laundering and terrorism financing. For the ATO, the government indicates that the proposed additional powers will be used for “protecting public revenue from serious financial crimes”.

“With respect to the ATO, access to telecommunications data would support or, in some cases, potentially replace expensive, resource-intensive and intrusive physical surveillance operations.”

"Communication" to include electronic data & information

As a part of the consultation paper, the government is also seeking to broaden the definition of “communication” to include a range of information and data transmitted electronically, including:

- electronic conversations and messages between people, whether they are travelling between devices or stored by a telecommunications provider or on a person’s device or personal network. This includes phone calls, emails, instant messages, video conversations, and conversations via messaging apps. It will also encompass draft/unsent emails or messages that sit on a carrier/carriage service provider’s server.

- an individual’s activities on the internet comprising of web-browsing history, URLs visited, use of non-messaging apps on their smart phone.

- electronic documents, files, images or other content created by an individual, regardless of whether they are transmitted to another person (e.g. text documents, images either saved on a computer or cloud storage).

- interactions between an individual and a machine (e.g. instant messages between a person and an automated system such as a chat-bot).

- interactions/signalling information between a machine and another machine (e.g. data generated by connected or autonomous vehicles, smart home security systems etc).

Additional ATO powers

According to the paper, the government is seeking to grant the ATO with additional powers as it will complement their existing investigative powers, which are already quite vast as anyone who has had dealings with the ATO would already know. While the paper indicates that the additional powers will be aimed at individuals committing tax fraud, it will also be “used to exclude non-involved individuals from lines of inquiry”, meaning that if you have any association with anyone involved in an inquiry, your data could be accessed.

At this stage, the paper does not appear to contain any information or proposals on how the data accessed in the course of eliminating non-involved individuals will be used. While it touts various safeguards in regard to the access and use of private information, it is unclear what exactly these protections will be.

It will be interesting to see how these proposals develop through the consultation phase and, if implemented, what protections and safeguards will be put in place to protect taxpayers’ right to privacy.

Disclaimer: The information on this page is for general information purposes only and is not specific to any particular person or situation. There are many factors that may affect your particular circumstances. We advise that you contact Mathews Tax Lawyers before making any decisions.